week #45 - 2025

bonds and equity update.

Good morning folks,

Following a busy week across global rates, positioning continues to shift. We’re seeing a meaningful rotation in front-end shorts and renewed divergence between funding legs and peripheral carry trades. Let’s go through this week’s picture.

Global Equities

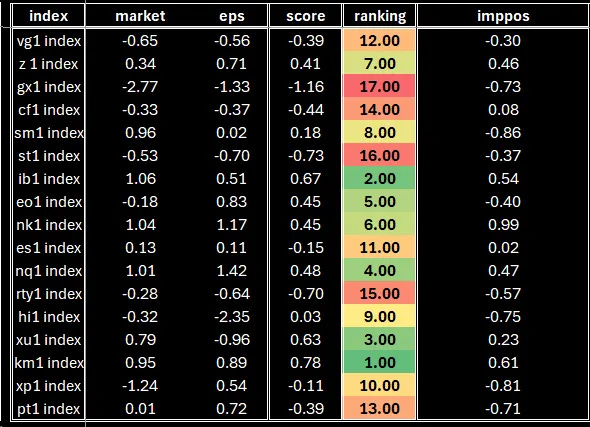

APAC equities remain strong, led by KOSPI, China, and Nikkei—still our preferred plays. We added on the dip to our long IBEX position and continue to hold firmly. Nasdaq remains a good performer, along with its European counterpart AEX.

On the short side, we remain positioned in RTY, CAC, and Eurostoxx, which continue to serve well as funding legs.

Overall, we maintain a net long exposure, but we’re mindful of stretched positioning and will use retracements to add.

Keep reading with a 7-day free trial

Subscribe to spaghettilisbon's Market Digest to keep reading this post and get 7 days of free access to the full post archives.