week #29 - 2025

Good morning, folks. Welcome to a fresh update on signals—we will cover both equity and fixed income, looking at macro signals and market ones.

First, let's review the systematic signal dashboard:

We start with fixed income, where I have most of my risk. Trends are unidirectional on the short side. We see strong shorts at the long end in both the US and Germany, with both BUXL and Ultras having extreme short positions. The same applies to all other markets except the front end, where we have mild shorts in Schatz. Only positive trends are in BTS and BTPS.

What stands out to me is the extreme positioning in fast trends in: Ultras, 10s, BUXL, Bunds, OATs, Gilts, and JGBs. You can see it also in the acceleration numbers. We might be too skewed, and the probability of mean-reversion has increased.

Composite signals continue to be mostly shorts across the board. The front end is getting murdered, with US 2s scoring -0.83 and Schatz -0.63. Signals are not supportive for a steepener currently, but we think macro plays a larger role here. We're keeping the trades as we believe the trend is clear for a steeper curve. In Germany, the curve you could play is 10s30s, which can best reflect the "fiscal risk premium"—it has the right score and provides carry, so overall not bad.

For outright positions, we are playing JGBs short, but we covered some as we see a strong negative trend and potential turmoil coming from elections over the weekend.

On a cross-sectional basis, a few trades we like are long US 5s vs short Bobl, and (OAT + BTPs) / Bunds, although spreads are very tight, especially vs BTPs, and we would prefer to play OATs vs Bunds. Gilts can be an interesting short leg for a pair trade, maybe against BTPs.

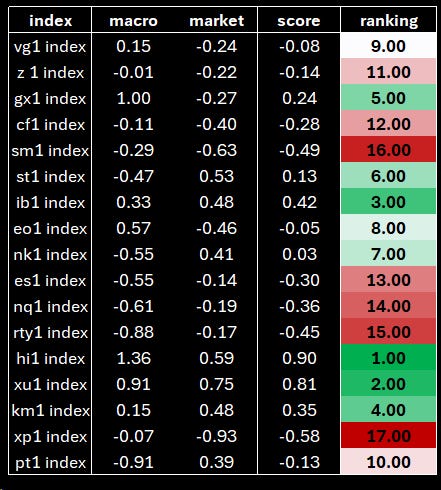

When we factor in macro and other factors, we get the following output:

We confirm the bias across intra-EMU spreads. JGBs are outright shorts, while at the bottom of bonds we find South Korean ones along with Gilts. It's quite interesting to see a very bearish score in Bunds in macro, while the market is more mild. Note also how OATs provide very good real yield cross-sectionally and have positive carry (but high vol).

At the top of my list is the OAT/Bund tightener. Let's see if we can get the chance to get in with size, maybe above 70bps.

Moving to Equities

Here the picture is much clearer. Systematic scores are positive across the board, and we continue to see positive developments despite tariffs and everything else.

At the top of the list, we find Asian markets like China, KOSPI, and Hang Seng. We continue to have positive signals in Europe too, mostly coming from trend scores. CAC is no longer a good candidate for short legs if we look at the composite score.

We can move further and look at macro and markets. For "macro," we refer to the AQR paper already mentioned multiple times—I reviewed it here.

We confirm the trend and continue to see positive catalysts for China and Hang Seng. These were forgotten markets, and they provided solid returns over the last few weeks.

US equities are still a laggard, mostly due to macro scores, but we are playing the long side as a thematic play on weak dollar, positive fiscal impulse, and likely "beats" in earnings season. European markets look good, with EuroStoxx and CAC as potential short legs. DAX is in the top five, as you'll notice.

Putting It All Together

We continue to think equities have room to run, driven mostly by fiscal impulses, positive momentum, and decent carry signals. Until long-end yields skyrocket, we are safe. In my portfolio, I keep the longs in the thematic baskets we mentioned multiple times.

In fixed income, I'm looking to get into OAT/Bunds, but most of my risk is in steepeners 2s10s.

I'm running a small position in BTP/Bund, I'm short JGBs, and playing the short side in SFRZ5 (trading it heavily, surviving the "firing Powell" story). I keep the M6M7 Euribor steepeners (cut it a bit) and still holding SFIU5H6 flatteners where, strangely, I'm losing money (if you find someone who makes money in SONIA, please let me know).

I started a long 5s vs Bobl based on scores and macro trends. Along the same lines, macro trends support long equity vs bonds in Europe (driven largely by fiscal + scores), so I'm long DAX vs Bunds.

That's everything for today.

Take care,

spaghettilisbon