week #20 - 2025

Global bond market tremors, inflation risks, and the flow-driven resilience of peripheral Europe.

Good morning folks,

Bonds made headlines this week following a poorly received 20-year auction, which rattled both fixed income and equity markets. As of Friday morning, we’re seeing US bond yields lower on the 2s and 5s, while rising on the 10s and 30s. The S&P (ES) is also down for the fifth consecutive day.

Macro Snapshot

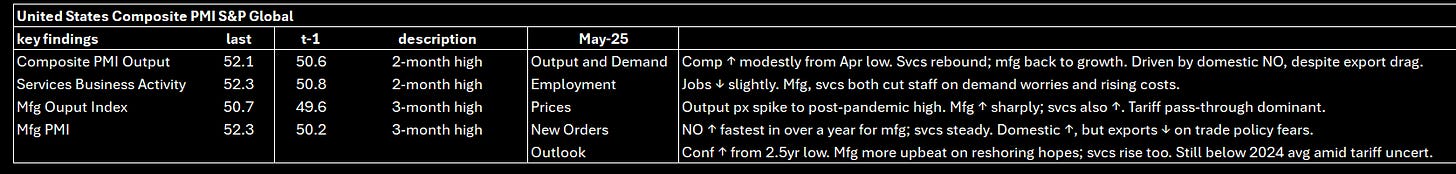

From the PMIs, the US economy appears to be holding up. Manufacturing new orders are picking up—particularly domestic ones—with re-shoring activity providing a tailwind. Services remain stable. Overall, we continue to believe the US economy is resilient. The labor market is flat, but we see no notable stress in our fiscal flow tracker. The real concern now is inflation, with upside risk for the next CPI print.

This aligns with our previous fiscal reviews: flows remain supportive, as shown below. Unemployment benefits are steady, tax revenues are robust, and there are no recession signals—at worst, a mild slowdown.

Eurozone

We include our PMI commentary for the Eurozone below.

Personally, I expected stronger results. The narrative remains unchanged: peripheral economies are outperforming the core, which is what matters most. Risks in Europe stem from the upcoming French elections in July, while the ECB is on track to cut in June. If there's any central bank likely to move "below neutral," it’s the ECB. Business sentiment is weak, largely due to margin compression.

Global PMIs

We’ve also included PMI data for Japan and Australia.

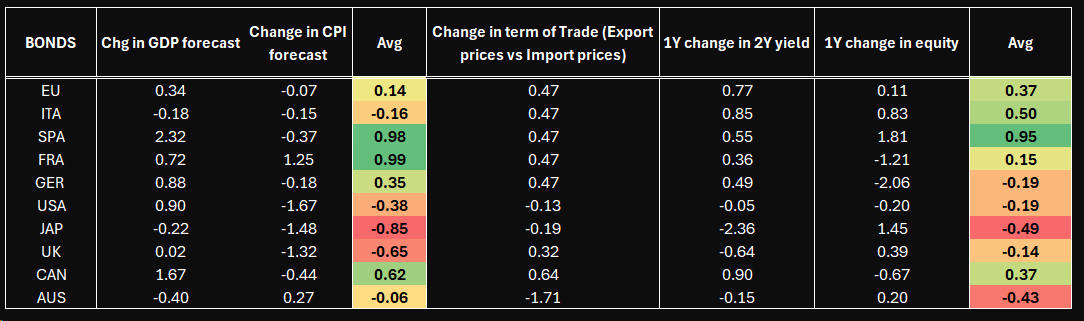

Systematic Signals – Fixed Income

Trend signals remain mostly bearish across the board. Bright spots: BTPs and BTS. The Schatz is weakly positive but has seen a notable reduction in long positions, with fast money now flipping short. The worst trend signals are in Canada 10s (following a stronger-than-expected CPI), Ultras, Gilts, and US 10s.

Implied positioning looks stretched in several contracts: Ultras, Buxl, Gilts, and JGBs.

Composite scores offer a clearer read:

US front-end: short (-0.76)

BTPs and BTS: top longs (0.92 and 0.80, respectively)

OATs and Bobl: mildly bullish

Bunds: neutral

Other 10s: either bearish (Gilts, Canada, US) or neutral (JGBs)

We also screen systematic macro inputs to refine our trade ideas (more on this below).

Keep reading with a 7-day free trial

Subscribe to spaghettilisbon's Market Digest to keep reading this post and get 7 days of free access to the full post archives.