Good morning folks, and welcome to another week of fiscal updates. This week, we’re covering Week 38 of the fiscal year.

We've made some structural changes in how we track the data. We now compare total spending to GDP, and have further optimized our methodology to account for holidays and similar calendar effects.

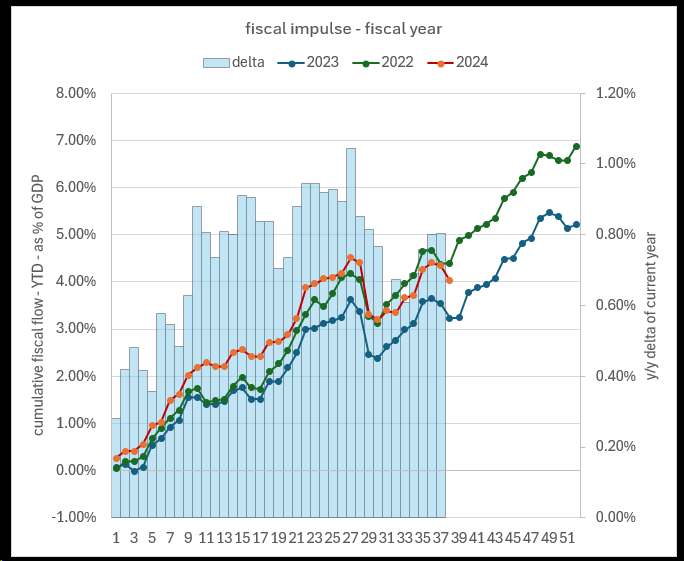

Fiscal Impulse

For Week 38, we anticipated a net liquidity drain—and that’s exactly what occurred. There was a total drain of $91.6 billion, which is $4 billion more than the same period last year. This brings the 4-week average impulse to $14.7 billion. The drain was also higher than the 3-year average, as shown in the table.

The current nominal year-to-date (YTD) surplus stands at $281 billion compared to the same period last year.

Relative to GDP, the fiscal impulse remains robust. We are currently at 4.03% of GDP, which is 80 basis points higher than this time last year. On a year-over-year basis, we’ve seen an acceleration in recent weeks, setting the tone for what’s ahead.

Keep reading with a 7-day free trial

Subscribe to spaghettilisbon's Market Digest to keep reading this post and get 7 days of free access to the full post archives.